Win With The Champ Plan

Win With The Champ Plan

$573 In Savings Per Employee

$0 Net Cost to the Company Or Employees

Increase Employee Take-Home Pay By $1500

Significantly Lower FICA Taxes

24/7 Coverage and Support

A Brand You Can Fully Trust

we Proudly Stand With Affordacare To

Provide The Best For Our Communities

Affordacare has become a leading insurance provider in the country and allows us to provide Colorado with some of the best insurance that there is to offer.

$1,000,000,000+

In Total Savings For Our Clients

800,000 Happy Active Clients

11,000+

Agents Nationally

58

Locations Nationally

NEXT STEPS!

STEP 1

Schedule Consultation

STEP 2

Review Proposal

Step 3

Choose Plan & Start Saving

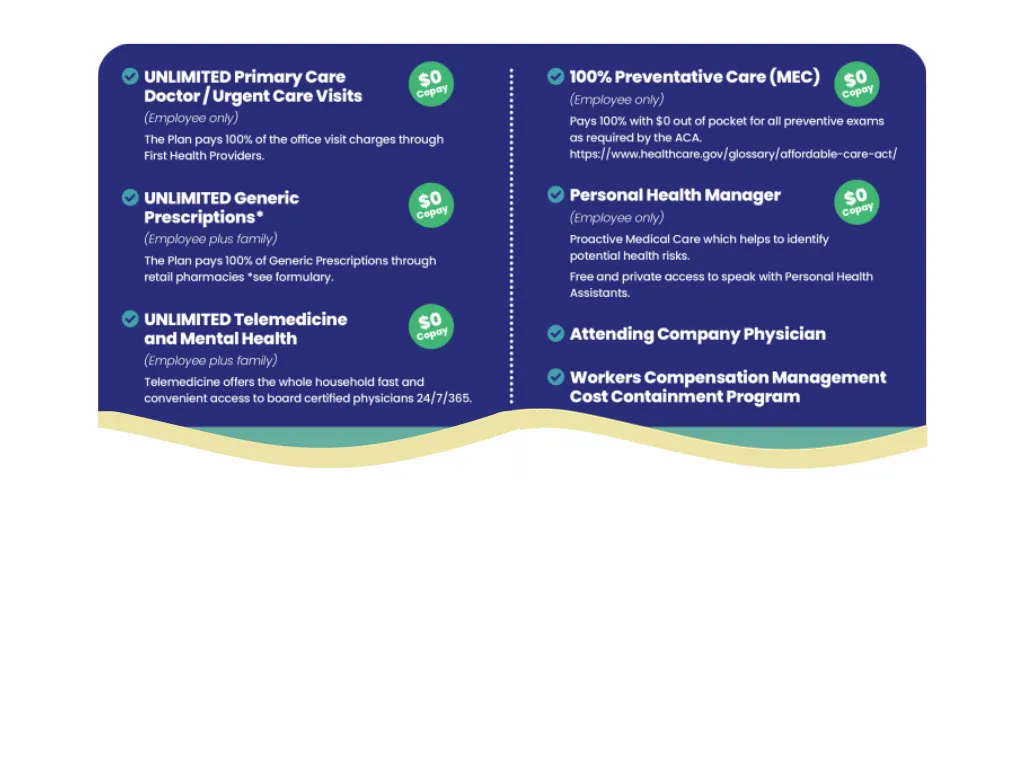

How Your Employees Win

$1500 (AVG) Annual Increase of Take Home Pay

How Employers Win

$573 In Tax Savings Annually For Each Enrolled Employee

Increase Benefits of Existing Health Package

- A Simple, Co-Existing Add on

Reduce Usage of the Primary Care Resulting In Future Savings - Use Champ First

Happier & Healthier Employees And Their Families

Champ Enrollment Team Enrolls Everyone - Completely Autonomous, No Burden to HR

Best Customer Service In The Business - Champion Health, Inc.

Recruit & Retain Highly Valued Employees

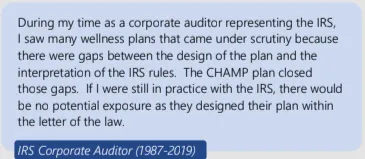

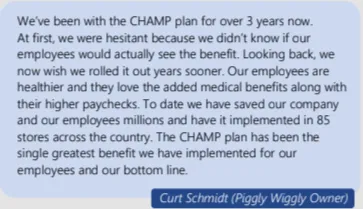

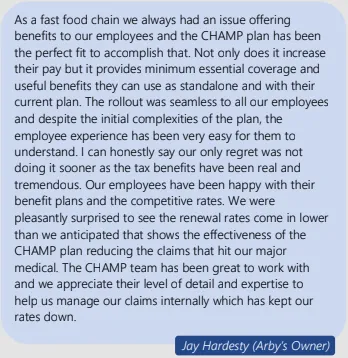

What clients say about us

Frequently Asked Questions

Is the CHAMP Plan Compliant?

YES. The CHAMP Plan is not a wellness plan nor a reimbursement plan. Therefore, Section 105 is not applicable towards this plan. The CHAMP plan is a complementary healthcare plan that overlays the traditional benefit plan. It is a qualified Section 125 cafeteria plan. It is set up as a self-funded employer sponsored plan that is 100% funded by the employees through a pre-tax payroll deduction. The amount deducted represents the maximum claims for the policy year. The Third Party Administrator (TPA) holds the monies in a custodial account and pays claims as they incur in accordance with the plan document and the schedule of benefits. The definition of a claim is defined as 1. Claims made to Providers, 2. Claims made to Facilities, 3. Claims made to Pharmacies, and 4. Claims made to Employees. Claims made to employees are triggered when an applicable CPT code is triggered with a corresponding explanation of benefits (EOB). Examples of these claims are preventive examinations, biometric screens, health risk assessments, chronic medication fulfillment, etc.. Claims made to employees are not taxable nor considered ordinary income. The amount of premium charged to the employees is actuarially set to cover the claim risk on the plan while meeting a desired medical loss ratio (MLR). At the end of the plan year and the runout period, any surplus left in the claim account is considered a plan asset to the employer.

Does participation in the CHAMP disqualify me from participating in my traditional High Deductible Health Plan w/an HSA?

NO. The CHAMP Plan is a separate medical plan with it’s own plan document and benefit schedule. Any claim processed through the CHAMP will follow suit in accordance to those outlined rules. Claims processed through the traditional HDHP w/HSA will need to meet the minimum first dollar cost share requirements by the employee to remain qualified.

Does the CHAMP plan meet the definition of Minimum Essential Coverage (MEC)?

YES. The CHAMP Plan is an employer sponsored health plan and meets the definition of Minimum Essential Coverage.

How much on average does a company save per employee by using the champ plan?

$573 Per Employee Annually!

Contact Us

(303)335-7458

info@betteremployeebenefits.org

Hours: Monday – Friday

10:00am – 5:30pm